Policy Brief

Governments’ role in the global semiconductor value chain #1

Authors

Programmes

Published by

Stiftung Neue Verantwortung

June 07, 2022

Executive Summary

The global chip shortages led to severe disruptions in many end-customer industries, such as automotive and medical equipment. To anticipate and ideally alleviate future chip shortages, Europe is proposing a highly granular government supply chain monitoring in the upcoming EU Chips Act. Similar plans are also discussed within the EU-US Trade and Technology Council. Based on the assessment that there is a lack of transparency within the global semiconductor value chain and information asymmetries between suppliers and end-customers, the European Commission wants Member States to monitor ‘early warning indicators’ to ensure supply security for end-customer industries.

This paper provides an overview of the key challenges of such a government supply chain monitoring, putting into question the efficacy of the plan. While we agree that the semiconductor value chain needs to become more transparent to increase resilience, governments should place the responsibility for such a monitoring on semiconductor companies and end-customer industries. Governments, as bystanders to this value chain, will struggle to gather, assess, contextualize, and ultimately act on the type of highly granular data that is needed to anticipate shortages. Instead, governments should work with and push industry to own the issue of supply chain monitoring.

This is the first paper in a series that analyzes governments’ role in the global semiconductor value chain. The second paper elaborates why a long-term government mapping of the global value chain should be established. The third paper explains why the European Commission’s planned crisis response toolbox, as proposed in the EU Chips Act pillar 3, is neither efficient nor effective to alleviate semiconductor shortages.

Introduction

Since 2020, the severe impact of the global chip shortages 1 has put many governments under pressure to help their domestic incumbent industries. The governments realized that chips are indispensable to almost all sectors—from agriculture to energy, finance, automotive, and many more. Trying to figure out what went wrong and how to be better prepared in the future, governments gathered information about the semiconductor value chain 2 to better understand the interdependencies, vulnerabilities, and chokepoints. 3 It quickly became clear that there is a lack of transparency within this value chain and information asymmetries between end-customer industries and their chip suppliers.

This led the European Commission (EC) to focus the third pillar of the EU Chips Act 4 on supply security for end-consumer industries through supply chain monitoring and crisis response tools. First, the act states that a government monitoring approach should be put in place with the goal of anticipating future disruptions. Second, the act introduces a Crisis Response Toolbox, which comes into effect once a semiconductor crisis is officially declared.

Our analysis shows that the EC’s envisioned government supply chain monitoring will most likely be neither efficient nor effective in achieving the goal of anticipating future disruptions and securing semiconductor supplies for end-customer industries. This can be explained by looking at the proposal from three different perspectives: scope and granularity, data access, and governance and technical expertise. As governments are neither producers of chips nor an important end customer, we argue that highly granular monitoring of the supply chain with the objective of increasing the transparency and resilience of the semiconductor value chain should be the responsibility of companies—in the semiconductor supply chain and its end-customer industries. Because governments are neither producers of chips nor an important end customer, they should put the monitoring responsibility on companies to make the semiconductor value chain more transparent and resilient.

This does not mean that we oppose the need for governments to gain a better understanding of the semiconductor value chain. Instead of monitoring, we propose that governments invest in long-term strategic mapping of interdependencies within the value chain. The goal of such mapping would not be to identify short-term supply constraints or forecast demand fluctuations but to assess long-term supply chain resilience and inform strategic policy tools, such as investment screening and export restrictions. Although such mapping would also rely on external data, it differs from supply chain monitoring in scope, goal, and necessary frequency.

This paper explains why governments should place the responsibility for supply chain monitoring on semiconductor companies and their end-customer industries. The next paper in the series introduces the idea of government mapping as a more meaningful way for policy makers to navigate the complex semiconductor value chain.

The following sections elaborate how the proposed monitoring system would work, analyze why it is not fit for purpose if conducted by governments, and finally, provide recommendations to governments for how to establish industry-driven supply chain monitoring that could be included in the EU Chips Act.

This is the first paper in a new series analyzing and assessing the role governments can and should play in the global semiconductor ecosystem. Although the paper is focused on the EU Chips Act, most of our arguments are also relevant to similar discussions in other regions.

European Commission proposal: Supply chain monitoring

The monitoring mechanism in the EU Chips Act pursues the objective of anticipating disruptions or crises in the semiconductor value chain to ensure a timely policy response. The EC states that individual industry monitoring initiatives are not sufficient, as they “look only at individual supply chains and do not cover all relevant end user industries.” 5 Therefore, the EC wants to survey the “total effective chip demand per chip family” by collecting companies’ individual demands via “a trusted platform for demand forecast.” 6 The EC wants to establish and monitor “early warning indicators” (see info box below), which will be determined through an EU-wide “Risk Assessment.” 7 The list of initial indicators suggests a monitoring system that is highly granular, is wide in scope, requires expert knowledge to conduct, and encompasses near real-time information.

In addition to the early warning indicators, information about fluctuations or disruptions provided voluntarily by so-called “key market actors,” users of semiconductors, and other relevant stakeholders is proposed to be collected through an information channel or “administrative setup”. 8 The EU member states will play a central role in keeping track of all early warning indicators and the information received from all actors in their territory to alert the EC in case of a potential crisis. Their findings will be exchanged with the new European Semiconductor Board chaired by the EC (figure 1).

figure 1

What the EU Chips Act suggests between the lines is that the proposed monitoring system would allow the EC and member states to provide better forecasting of fluctuations in demand and impeding shortages than the industry itself. This will not work for several reasons.

Challenges governments face when trying to forecast demand and anticipate shortages

How can data be obtained without trust and incentives?

Governments are not part of the value chain and therefore, rely on data from the private sector, ranging from semiconductor companies to market analysts, as the basis for their monitoring. In order to create its own demand forecast and compare it to available manufacturing capacities to predict shortages, the EC needs industry information such as lead times, fabrication plant (“fab”) utilization rates, inventory levels, and so on. 9

Semiconductor companies are more likely to share valuable and detailed data with governments if the companies perceive the governments as trusted stakeholders in the value chain and if sharing data provides a clear benefit for the semiconductor company. However, the EU Chips Act and the accompanying documents (Communication, Recommendation, and Staff Working Document) do not explain how the EC and member states would establish a trust relationship with the semiconductor industry. For example, a critical question is data handling, including how to ensure that company information is not shared with other government agencies for other purposes. The EC simply states that “any collection or exchange of information should be in line with applicable rules on data sharing and confidentiality of information and data” 10 and dedicated a single article (Article 27, The EU Chips Act) to this matter. Especially considering the discussions within the EU–US Trade and Technology Council (TTC) about supply chain monitoring, it is crucial for semiconductor companies to know whether their company data will also be shared with the U.S. government. 11 Unfortunately, the EU Chips Act is silent. The EC and member states missed the opportunity to explain to semiconductor companies why they can be trusted to take on this new role as market analyst and “trusted source of data.” 12

There is not just a lack of trust; there is also a lack of incentives for semiconductor companies to share meaningful data with governments. Pillar 3 of the EU Chips Act is written from the perspective of end-customer industries, such as automotive. This makes sense because, at the end of the day, semiconductor companies are suppliers to these industries. However, semiconductor companies, whose collaboration is crucial to make the monitoring mechanism work, will share meaningful data only if it also benefits them to some degree. Again, the EU Chips Act does not mention how such monitoring would benefit the semiconductor industry. In the current draft, information flows only from the industry to governments.

Because the EC’s monitoring would rely heavily on company data, the EC and member states must communicate much more clearly why they can be entrusted with this data and how the semiconductor industry would benefit. If governments fail to do so, companies will simply share very little data: For example, of 164 respondents to the U.S. Department of Commerce’s request for information (RFI) in September 2021 about the semiconductor shortages, only 44 were semiconductor companies, while 55 companies were in end-customer industries. 13

Market forecasts are tricky and do not reveal scarcities

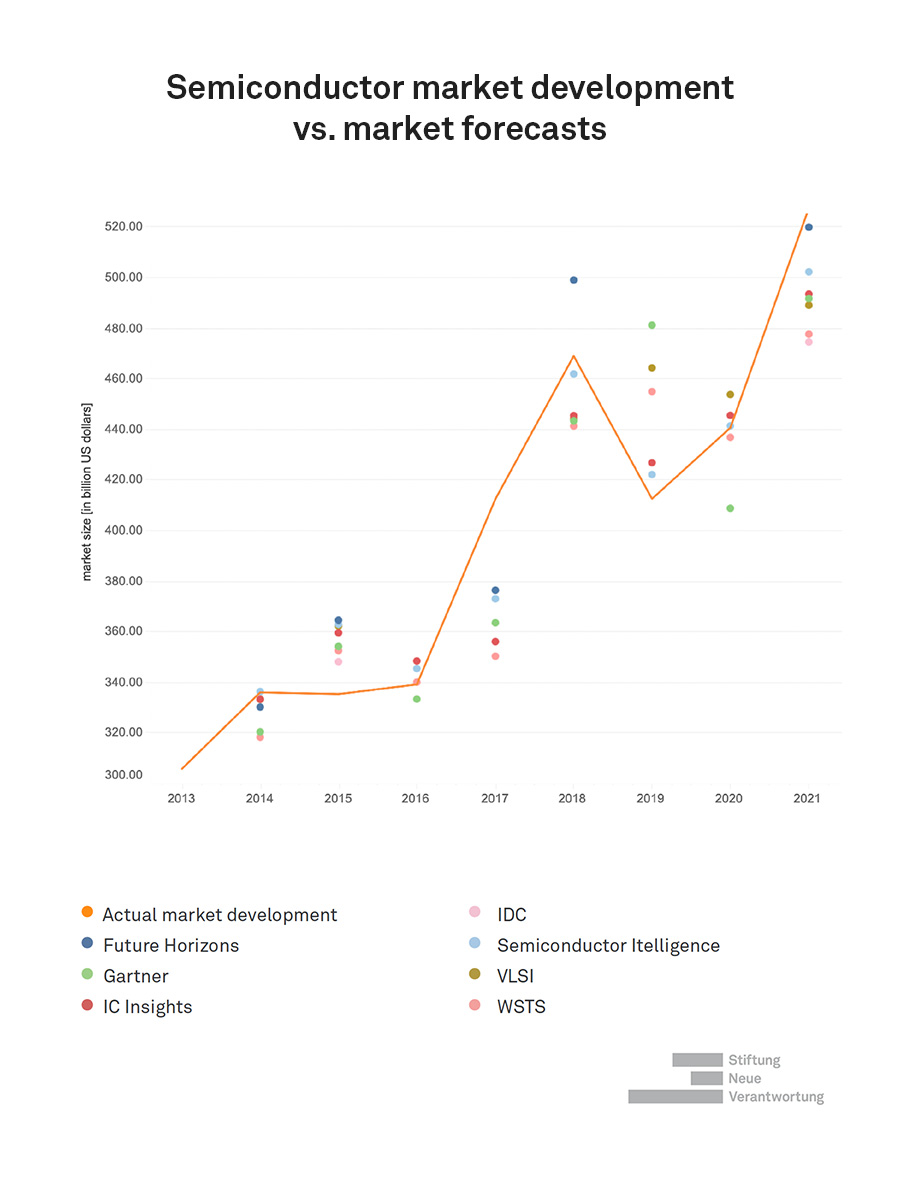

The current shortages are mainly due to chip demand exceeding manufacturing capacity (supply). Accordingly, it makes sense that the EC also wants to track and forecast semiconductor demand to anticipate future supply constraints. Whether the EC and member states intend to create their own forecasts or draw on the forecasts of established market analysts is unclear. Some phrases in the EU Chips Act and associated documents suggest the former. 14 The problem is that the industry itself struggles to reliably forecast the market within reasonable margins of error (figure 2). 15

figure 2

You can find the interactive version of this graphic here, or by clicking on the image.

What do you see?

The interactive chart compares one-year market forecasts from multiple analysts and consulting firms (colored points) to the actual development of the semiconductor market (solid orange line) between 2014 and 2021. You can toggle between absolute numbers (in billions of US dollars) and relative numbers (percentage of market growth) using the buttons above the chart. Click on the points in the chart to display further information about each forecast, including the date of publication. By clicking on the points, the chart also reveals how much the forecasts deviate from the actual market development in concrete numbers.

What does it mean?

The chart highlights that even expert firms that are specialized in semiconductor economics and build on years of experience cannot predict the next months of market development reliably. Looking at the relative numbers, it becomes clear that the community of market analysists is off around 6 percent on average. Although forecasts sometimes get close to the real market development, deviations of more than 10% are perfectly normal. In some years, analysts were not even right about the general trend of market development. For example, in the end of 2014 / early 2015 all analyst firms predicted a year of growth, but the market declined. This underscores how volatile and unpredictable the semiconductor market is.

Although companies in the semiconductor value chain typically use a variety of different forecasts combined with their own internal analysis, they were not prepared for the 2020 shortages. It would be naïve to think that the EC, together with member states, could anticipate shortages based on existing market forecasts—which private sector companies have failed to do—let alone establish more accurate forecasting.

Lack of resources and supply chain expertise

To request the right information from companies and correctly interpret the received data to anticipate future disruptions, the respective authorities in the member states and EC staff would need substantial expertise in the semiconductor value chain, including a solid grasp of the semiconductor manufacturing processes, the different technologies and materials involved, end-customer requirements, and market dynamics, to name just a few. However, the impact assessment for the EU Chips Act estimates that only nine additional full-time staff equivalents are needed—for the implementation of the entire EU Chips Act, not just supply chain monitoring. Even if most of the data gathering for supply chain monitoring is conducted by member states, analyzing all the incoming data would require substantially more staff.

The low estimate for the government resources needed combined with the necessity to hire experts with diverse backgrounds (data analysis, economics, and deep technical knowledge) for government supply chain monitoring calls the effectiveness and efficiency of the proposed measures further into question.

Instead of monitoring the supply chain, increase transparency for all industries

The previous section elaborated on all the challenges a government will face when trying to closely monitor the semiconductor supply chain to anticipate and ultimately, alleviate shortages. First, any government monitoring would rely extensively on data received from semiconductor companies. Companies share relevant supply chain and market data only if they trust the government to act on that data. Furthermore, for semiconductor companies to participate, there must be a clear benefit. Second, forecasting chip demand is hard, and market analysts with considerably more resources and experience than the EC and member states often fail to do so accurately. In addition to the lack of access to, as well as limited sources of, meaningful data, governments would need substantial resources and supply chain, technology, and market expertise to make sense of the received data.

Instead of trying to closely monitor the semiconductor supply chain from the outside with the aim of anticipating shortages, governments should push the semiconductor industry to become more transparent and incentivize end-customer industries to better monitor their chip supply chain.

Industry and governments should work together to increase transparency in the ecosystem

There is certainly a lack of transparency within the semiconductor ecosystem that can and should be addressed by government intervention. For example, it is currently hard to find information about the manufacturing location (front-end and back-end) of a specific microcontroller and whether either of these production steps is outsourced. Yet, from an end-customer perspective, the risk of supply chain disruptions looks very different for a chip that is manufactured in the same region versus one that is manufactured in a foreign fab on a different continent. Together, governments and industry should develop supply chain transparency standards and best practices to increase transparency and thus, capabilities for every sector to monitor the supply chain and assess risks. The role of distributors and brokers should also be considered. 16

Incentivize end-customer industries to monitor their supply chains

As we are looking at a highly complex transnational value chain that is characterized by strong interdependencies, supply chain transparency is key to better understanding potential bottlenecks and their possible impact on the whole industry. Thus, the EC is right in their assessment that the semiconductor value chain should be much better monitored to ensure supply security and strengthen resilience. However, keeping track of lead times for certain chips and materials, in addition to utilization levels, natural disasters, and availability of pre-products, can and should be done by the respective end-customer industries together with the semiconductor supply chain.

For example, a certain type of microcontroller being in short supply due to an earthquake does not necessarily lead to supply chain disruptions. To what extent this impacts the actual supply of these microcontrollers to end-customer industries depends on various factors: Can this microcontroller in a particular product (car, washing machine, or MRT scanner) be substituted with microcontrollers from other companies? How much overstock is available to distributors? How much overstock does a particular end-customer company have? Can the manufacturing of this microcontroller be outsourced to (another) foundry? It is not feasible for anybody outside the value chain, including governments, to gather such (and much more) highly granular and often company- and product-specific data. Therefore, governments should hold the industry accountable to establish such monitoring. Some sectors, such as automotive, have already started work in this area. 17

Conclusion: Government supply chain monitoring—the right data in the wrong hands?

Factoring in all the challenges that come into play with the proposed monitoring approach, and assuming governments would have all the information they seek in their hands, policy makers would soon realize that, ultimately, room for action by governments is very limited. Governments cannot assess what a certain disruption means for a particular product; they cannot adjust inventory levels, search for substitutes, or shift production.

Companies can do all that. They are the ones that must adapt to disruptions and alleviate shortages. Since 2021, many companies have reevaluated their business models, questioning their procurement strategies as well as the lack of transparency within their supplier network. The type of information the EU Chips Act aims to collect is what end-customer industries, such as automotive and health, need to manage business continuity risks. The goal of monitoring, as stated in the EU Chips Act, is “to increase the ability to mitigate risks that may negatively affect the supply of semiconductors.” 18 Every single end-customer industry would subscribe to that goal.

Consequently, governments are not the right actors to conduct such monitoring. Interestingly, in contrast to the EU Chips Act, the EU–U.S. Trade and Technology Council’s Joint Statement in May 2022 says that both governments will “promote private sector efforts to increase transparency in the semiconductors value chain and in demand to anticipate shortages.” 19 This statement supports our argument that the responsibility should lie with the semiconductor industry, including its end-customer industries, and governments should hold the industry accountable. Governments should work with the industry to increase supply chain transparency for all sectors (i.e., through standardization) and should work on best practices and potentially, regulation of supply chain monitoring by the semiconductor industry and end-customer industries.

This does not mean that governments should not be involved in the semiconductor value chain at all. On the contrary, strategic mapping is essential to achieve supply chain resilience in two ways: First, to be able to hold the industry accountable and develop a monitoring framework the industry should deploy, governments need to understand the value chain’s interdependencies, chokepoints, and bottlenecks. Using that information, governments can figure out what type of information should be gathered from an industry perspective to better identify risks and alleviate shortages. Second, an in-depth understanding of the complex semiconductor ecosystem is indispensable for policy tools such as export controls, investment screening, and subsidies. Thus, continuous strategic government mapping should be the foundation for any policy action dedicated to strengthening the resilience of the value chain.

Our suggested strategic mapping and the proposed monitoring activities in the EU Chips Act complement each other. While the analyzed monitoring approach should be an ongoing and standardized practice within the industry with the goal of preventing or mitigating crises, mapping from a government perspective serves the objective of understanding and assessing long-term strategic interdependencies. Mapping the global semiconductor value chain requires understanding the relevance and competitiveness of important regions, companies, and end-consumer industries, assessing the criticality of chokepoints, and tracking the impact of industrial and trade policies as well as subsidies.

Our second paper in this series will elaborate further on why the purpose, contents, and governance of the introduced strategic government mapping idea is much more suitable for governments to play an active role in strengthening the resilience of the semiconductor value chain.

SNV’s previous publications on the semiconductor value chain

Table of Contents

1 For further information about the global chip shortages, see Jan-Peter Kleinhans and Julia Hess. 2021. “ Understanding the Global Chip Shortages.” Stiftung Neue Verantwortung.

2 This paper builds on previous SNV analyses of the global semiconductor value chain. A collection of these publications can be found above.

3 European Commission. 2022. “ European Chips Survey: Stakeholder Survey on European Chip Demand.”; Bureau of Industry and Security. 2021. “ Risks in the Semiconductor Manufacturing and Advanced Packaging Supply Chain.” BIS-2021-0011; Bureau of Industry and Security. 2021. “ Notice of Request for Public Comments on Risks in the Semiconductor Supply Chain.” BIS-2021-0036; U.S. Department of Commerce. 2022. “ Incentives, Infrastructure, and Research and Development Needs To Support a Strong Domestic Semiconductor Industry.” DOC-2021-0010-0001.

4 In February 2022, the EC proposed the European Chips Act, accompanied by four documents (Communication, Regulation, Joint Undertaking, and Recommendation). In May 2022, the Staff Working Document (SWD) was published. The EU Chips Act is divided into three sections: (1) “Chips for Europe Initiative” with the goal of supporting “investment into cross-border and openly research, development and innovation infrastructures”; (2) “mid-term security of supply actions to enhance semiconductor production capacity in Europe”; and (3) a monitoring mechanism and instruments for crisis response.

5 European Commission. 2022. “ Commission Staff Working Document: A Chips Act for Europe. ” SWD(2022) 147 Final, p. 88.

6 ibid.

7 The “Union Risk Assessment” is a process envisioned in the EU Chips Act during which the EU Commission evaluates the main risks, bottlenecks, and chokepoints in the EU semiconductor value chain. The Commission draws on information from each member state as well as its own assessments.

8 European Commission. 2022. “ Proposal for a Regulation of the European Parliament and of the Council. Establishing a Framework of Measures for Strengthening Europe`s Semiconductor Ecosystem (Chips Act).” COM(2022) 46 Final, p. 28 seq.

9 The SWD states: “Lead-time for certain chip types is one of the most important indicators, but also price changes, for both output and input, abnormal fluctuations in demand, and logistics data.”

10 European Commission. 2022. “ Commission Recommendation on a Common Union Toolbox to Address Semiconductor Shortages and an EU Mechanism for Monitoring the Semiconductor Ecosystem.” COM(2022) 782 Final.

11 The White House. 2022. “ U.S.-EU Joint Statement of the Trade and Technology Council.”

12 The White House. 2021. “ When the Chips Are Down: Preventing and Addressing Supply Chain Disruptions.”

13 U.S. Department of Commerce. 2022. “ Results from Semiconductor Supply Chain Request for Information.”

14 The Commission Recommendation includes information about the contents of the national risk assessments, which are to be conducted in preparation of the “Union Risk Assessment.” Among other points, the Commission recommends that member states should collect information about “the rate at which demand fluctuates for different types of semiconductors, also in relation to available manufacturing capacities.”

15 The interactive chart relies on multiple data sources. The semiconductor market data are publicly available information published in news reports by Semiconductor Industry Association (SIA). The forecast data were manually compiled from Semiconductor Intelligence’s annual blog posts about the state of the global semiconductor market, available via https://www.semiconductorintelligence.com/ To enrich the data gathered via the Semiconductor Intelligence blog, we manually searched for additional forecasts. We collected five additional data points through the following sources: Gartner forecast 2014, Gartner forecast 2016, Gartner forecast 2020, Future Horizons forecast 2015, Future Horizons forecast 2017.

16 See, for example, the work of companies such as SupplyFrame, SiliconExpert, and others.

17 See, for example, the work done by industry initiatives, such as Catena-X and others.

18 European Commission. 2022. “ Proposal for a Regulation of the European Parliament and of the Council. Establishing a Framework of Measures for Strengthening Europe`s Semiconductor Ecosystem (Chips Act).” COM(2022) 46 Final, p. 28.

19 The White House. 2022. “ U.S.-EU Joint Statement of the Trade and Technology Council. ”

Authors

Jan-Peter Kleinhans

Former Team Member

Julia Christina Hess

Lead Global Chip Dynamics

Wiebke Denkena

Former Team Member